Elevate Your Crypto Ventures: In-Depth Review of Electricity Incentives for Hosting

In an era where cryptocurrencies are revolutionizing the financial landscape, understanding the foundational elements that drive this digital economy is paramount. Hosting mining machines—an essential aspect for those looking to capitalize on crypto mining—offers a tantalizing proposition. It enables enthusiasts and dedicated miners to lean on optimized setups while alleviating the burdens of operational management. However, as any seasoned miner will tell you, the profitability of such ventures often hinges on factors including the cost of electricity, the efficiency of mining rigs, and the choice of the cryptocurrencies being mined.

The landscape of mining machines is replete with various choices, each optimized for specific cryptocurrencies. Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) are leading players, representing diverse opportunities and challenges in the mining sphere. BTC, known for its decentralized nature and large market cap, has become a gold standard within the crypto world. Surpassing various technological hurdles, miners must grapple with increasing competition and scaling complexities. This raises the stakes on operational efficiency, primarily concerning electricity consumption.

On the other hand, Ethereum has transitioned towards a proof-of-stake model, diminishing traditional mining practices but still retaining wide appeal among developers and crypto enthusiasts alike. Hosting provides an avenue for those looking to mine ETH before it fully transitions; this period could be viewed as an advantageous window of opportunity. Accommodated in data centers, Ethereum miners can leverage advanced cooling and power solutions, optimizing their operational environment while also benefitting from the communal resource-sharing aspect of hosting operations.

Contrast this with miners of Dogecoin. Initially launched as a lighthearted cryptocurrency, DOGE has captured the public’s imagination, elevating its market status unpredictably. While DOGE mining remains relatively less intensive concerning power requirements, hosting platforms can still present an excellent opportunity for cost savings on electricity—especially in regions with fluctuating energy prices and incentives for clean energy. The allure of staking rather than mining a coin could also shift the interest focus towards hosting services.

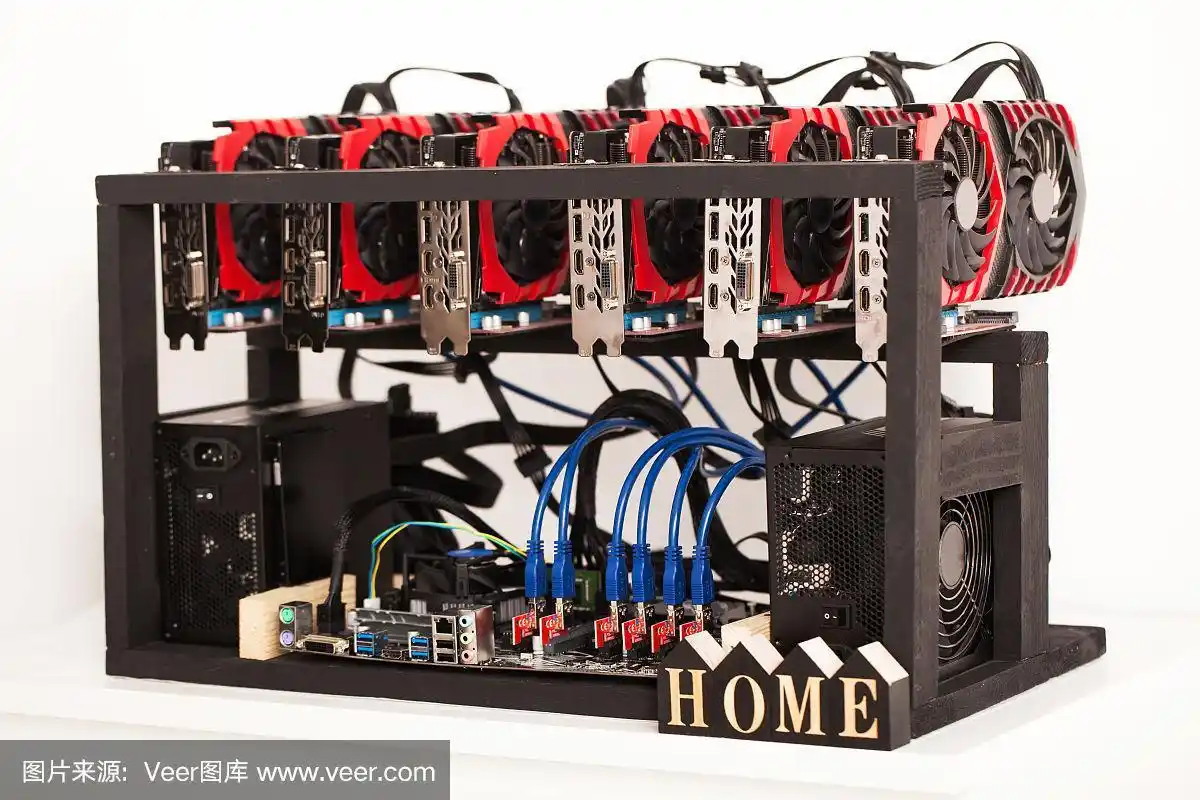

The relevance of mining rigs cannot be overstated. The race is not just for speed but for the most efficient electricity consumption. Cutting-edge ASIC miners for BTC boast remarkably high hash rates with optimized power inputs, translating to a direct impact on profitability. Every kilowatt-hour saved feeds into the bottom line, making it essential to exploit the best electrical tariffs available. Moreover, understanding and navigating the incentives from electric providers can yield significant advantages. Companies hosting mining operations might even enter specialized agreements that allow for reduced rates during off-peak hours, enhancing their capacity to generate revenue.

Mining farms truly represent the epitome of collective resource pooling and profit maximization. The operational dynamics of such setups can yield economies of scale, especially when they execute energy procurement strategies. In regions rich in renewable energy, hosting miners can enjoy not only reduced operating costs but also tax incentives and grants aimed at reducing carbon footprints. This aspect is increasingly crucial as regulatory frameworks globally tighten around energy consumption within the mining industry.

For individuals and organizations participating in the crypto buzz, mining machine hosting serves as a bridge between sheer passion and calculated business ventures. By adopting a systematic approach to understanding power dynamics—how to efficiently use electricity, its costs, and potential incentives—they can create a robust foundation for their crypto enterprise. Exchanges and price volatility underscore the importance of not just efficient mining but also strategic planning in hosting. Infrastructure investments, including facility location and energy contracts, must be at the forefront for miners who wish to thrive.

In conclusion, elevating your crypto ventures through informed hosting strategies can mark the difference between profitability and loss in a fiercely competitive domain. Whether one is looking to mine Bitcoin, Ethereum, or even Dogecoin, embracing a comprehensive understanding of electricity incentives and efficient mining practices is crucial. As the cryptocurrency landscape evolves, so should the strategies employed by miners. With optimal power usage and astute business acumen, the potential to turn digital ventures into gold awaits those ready to innovate and adapt.