DIY Maintenance Checklist for Your Bitcoin Miner

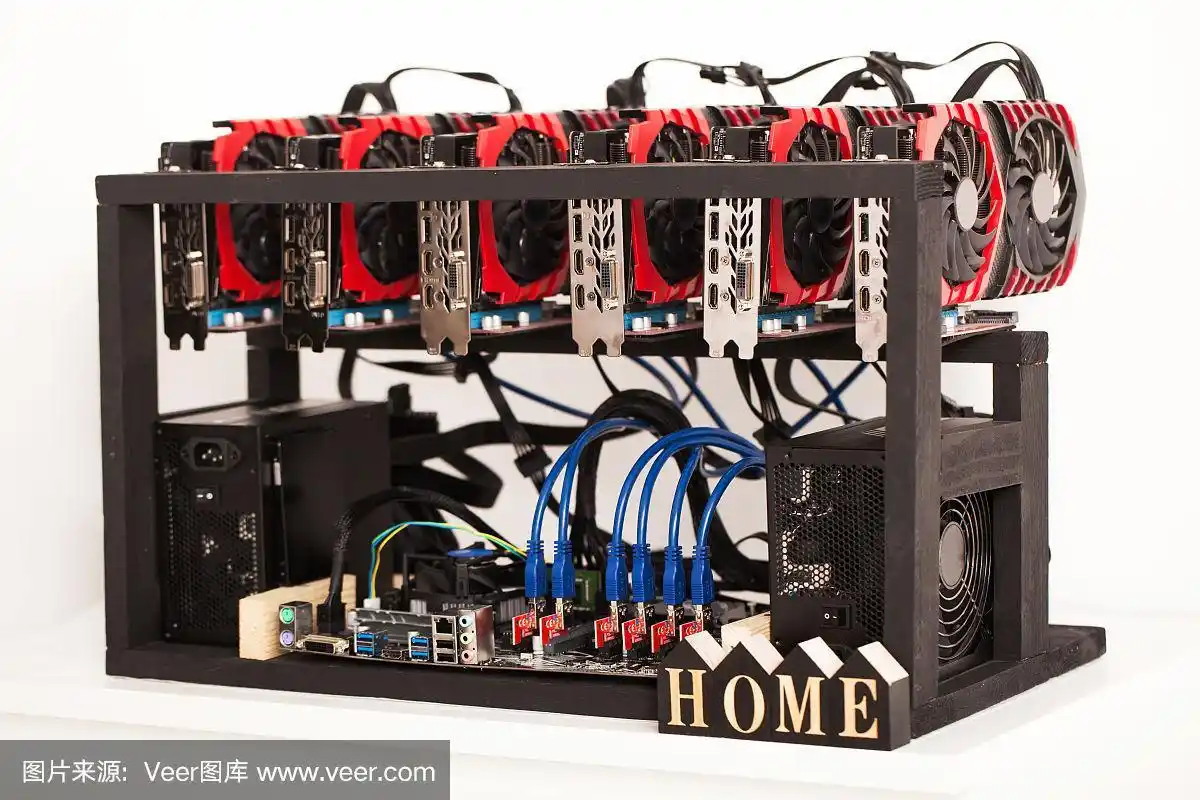

Owning a Bitcoin miner is a gateway to participating actively in the cryptocurrency revolution. However, the journey doesn’t end after setting up your mining rig; maintenance is paramount. Whether you’re running a small-scale setup at home or managing a substantial mining farm, keeping your equipment in pristine condition ensures optimal performance and longevity. A DIY maintenance checklist is a practical tool that enables enthusiasts and professionals alike to manage their miner’s health effectively.

First and foremost, keeping the mining machines clean tackles many potential issues before they surface. Dust accumulation is a silent enemy that can severely degrade the performance of mining rigs. The heat sinks and cooling fans gather grime over time, reducing airflow and causing the hardware to overheat. Regularly inspecting and cleaning these components with compressed air or an anti-static brush can prevent thermal throttling and unexpected shutdowns. Moreover, maintaining a dust-free environment around your miner lowers the risk of dust infiltrating the delicate circuits inside the ASIC chips, which are vital for hashing Bitcoin or Ethereum.

In addition to physical cleaning, monitoring the miner’s temperature is essential. Mining machines, especially high-performance rigs, generate immense heat during operation. You’ll want to ensure your cooling system—be it air conditioning, fans, or liquid cooling—is functioning impeccably. Temperature fluctuations not only influence the mining speed but also affect the miner’s hardware lifespan. Set up temperature sensors or use software tools to get real-time statistics and alerts. A well-cooled ASIC miner will maintain higher hash rates and yield better returns, whether mining Bitcoin or Ether.

Another critical area in the checklist is firmware updates. Manufacturers often release new versions of firmware for mining machines to boost efficiency, fix bugs, or enhance security. It’s tempting to skip these updates, but outdated software can expose your miner to vulnerabilities and suboptimal performance. Regularly check the official sources or software interfaces for updates, and follow the instructions carefully during installation. For those who manage hosted miners in third-party facilities, coordinate with the hosting provider to schedule firmware upgrades without disrupting mining operations.

Connectivity is yet another pillar supporting successful mining. The miner must remain connected to the blockchain network or mining pool to validate transactions continuously. Inspect ethernet cables or wireless connections regularly, and keep backup options ready. Network interruptions can cause your miner to fall offline, losing valuable mining time and diminishing profitability. Consider investing in redundancy solutions like dual internet connections or automatic failover to minimize downtime. Maintaining stable, high-speed connectivity becomes even more critical for hosting multiple mining rigs in a mining farm setup, where delays compound and ripple across your entire operation.

Don’t overlook power management on your checklist. Reliable power supplies and surge protectors shield your expensive hardware from electrical anomalies such as voltage spikes. Also, measuring the current power consumption helps identify abnormal spikes that signal possible hardware degradation or faults. Some miners use programmable power management units to automate shutdowns under unsafe conditions. Keeping detailed logs of voltage, current, and uptime supports predictive maintenance, which can save you from costly repairs or replacements down the line. This point is particularly crucial for miners handling multiple GPUs or ASIC machines simultaneously.

Temperature, dust, firmware, connectivity, and power management—each slot in your DIY maintenance checklist represents a compromise: neglect risks downtime and losses, attention maximizes productivity and device longevity. Embracing regular maintenance, whether you mine Bitcoin, Ethereum, Dogecoin, or altcoins, upholds your operation’s health and allows you to ride the waves of volatile crypto markets with confidence. Hosting providers, especially, gain a competitive edge by offering clients well-maintained rigs that minimize disruptions and ensure efficient mining performance.

Lastly, recordkeeping augments your maintenance strategy elegantly. Maintain logs detailing maintenance activities, anomalies detected, parts replaced, and performance metrics. Over time, this treasure trove of data helps spot recurring issues and best practices tailored to your rig type or mining environment. Employ spreadsheets or dedicated maintenance apps designed for mining operations to keep this data accessible. In a mining farm, where dozens or hundreds of miners hum simultaneously, structured recordkeeping supports swift troubleshooting and stable uptime, ultimately translating into sustained profitability.