The Ultimate Guide to Cryptocurrency Mining Hosting Contracts in the UK

In recent years, the cryptocurrency boom has sparked interest and innovation in various spheres of investment and technology. One such facet is the realm of cryptocurrency mining hosting contracts, particularly as they relate to an ecosystem of cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG). This guide will walk you through these exciting opportunities available in the UK, and illuminate the landscape of mining machines, hosting services, and the intricate processes that underpin these transactions.

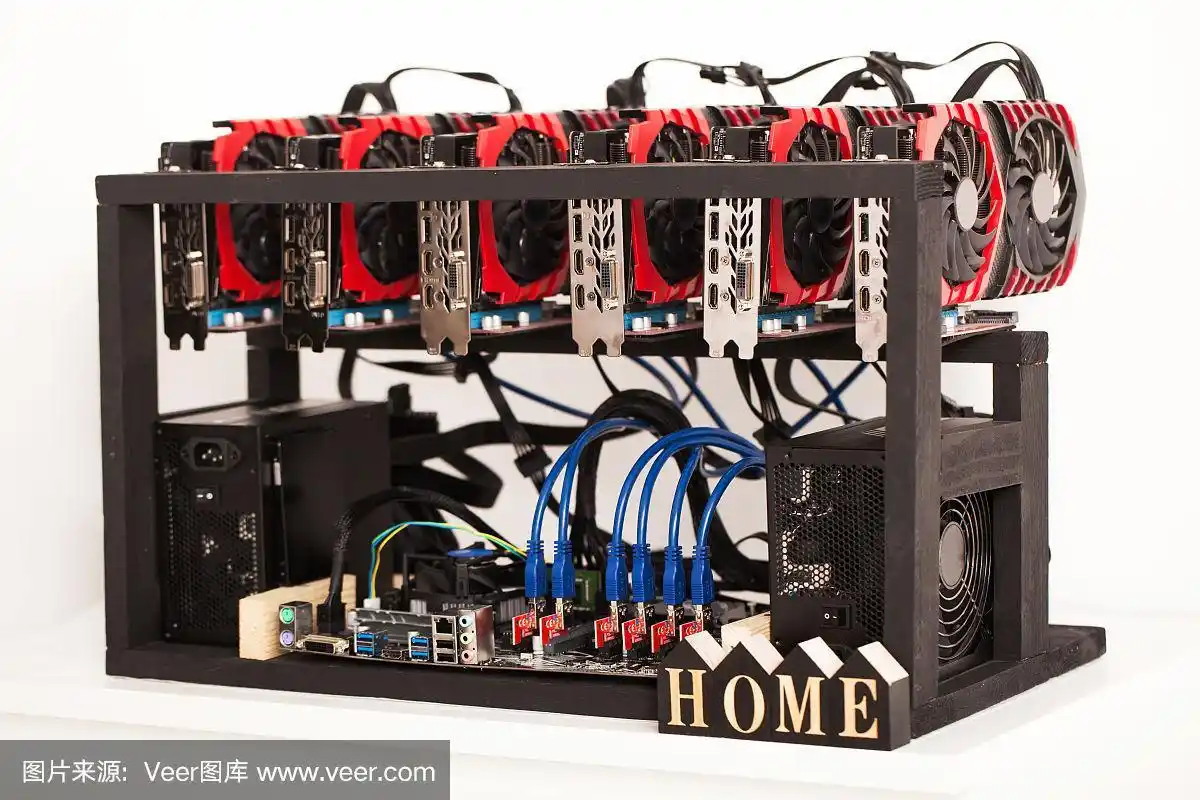

To comprehend the allure of mining hosting contracts, one must first grasp what cryptocurrency mining entails. At its essence, mining involves verifying transactions on a blockchain and securing network data, a process powered by mining machines—high-performance computers designed to tackle complex mathematical problems. Customers wishing to partake in this lucrative venture without the technical burden often turn to mining farm services, which provide the necessary infrastructure and management.

In the UK, the surge of interest in cryptocurrencies has led to a proliferation of mining farms, which offer hosting contracts that allow users access to powerful mining rigs without the hassle of setup and maintenance. Instead of purchasing expensive mining equipment and worrying about electricity costs, one can simply rent hashing power from a hosting provider, effectively simplifying the entry to this dynamic market.

When it comes to choosing a mining hosting provider, there are several key elements to consider. The reputation of the host, operational uptime, cooling solutions, and power efficiency are vital factors that could influence your profitability. More importantly, transparency in contract terms, fees structures, and the mining algorithms supported (like SHA-256 for BTC or Ethash for ETH) can significantly affect the returns you’ll receive from your investment.

As Bitcoin continues to dominate the market, its mining requirements evolve, presenting challenges even to seasoned miners. Newer cryptocurrencies, such as Ethereum, strive to develop alternative mechanisms (like Proof of Stake) to ease the energy burdens associated with mining. Thus, understanding the technological specifications and updates relevant to each currency becomes a requisite for prospective miners. Mining rigs geared for ETH may not render optimal performance for DOG or BTC mining, highlighting the need for tailored solutions when considering a mining hosting contract.

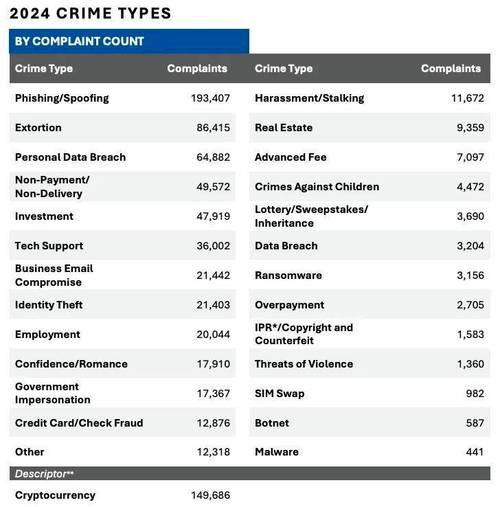

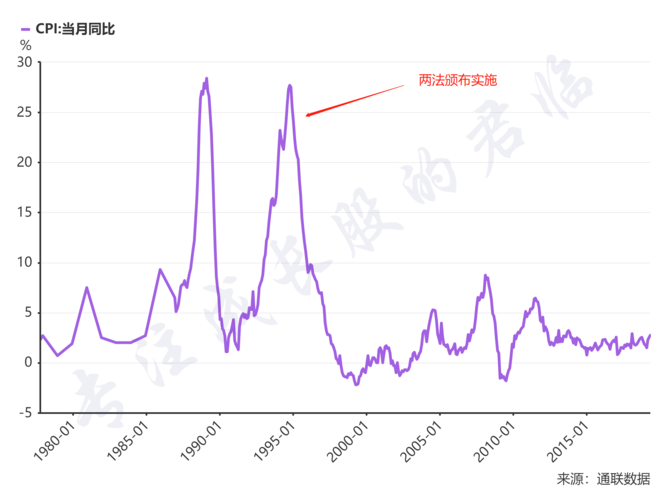

Moreover, the financial feasibility of mining is an essential aspect of this equation. Mining profitability fluctuates with the cryptocurrency’s market value, network difficulty, and energy expenditures. Therefore, diligent miners must continuously analyze market trends and re-evaluate their mining strategies. A sensible plan might involve diversifying investments across various cryptocurrencies and their corresponding mining methods.

In the context of cryptocurrency exchanges, hosting contracts provide an additional edge. Miners with access to reliable infrastructure can broker their mined currencies through exchanges swiftly and securely. The nature of contracts allows for greater flexibility in managing assets and responding to market shifts, providing a buffer against price volatility which characterizes the crypto market.

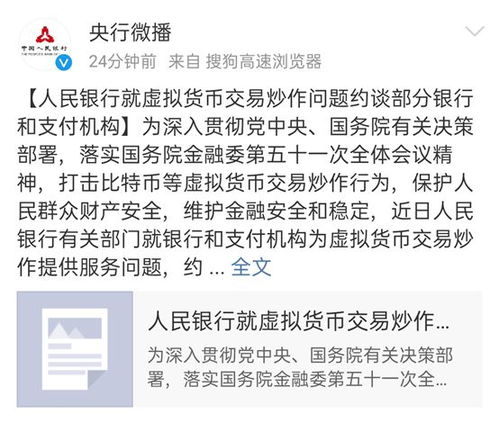

The regulatory landscape in the UK further shapes the cryptocurrency mining environment. Legislation remains dynamic; therefore, keeping abreast of potential alterations in tax implications and energy regulations can unveil new opportunities or risks. Understanding both the current law and expected changes will foster more informed decision-making regarding hosting contracts.

For those considering entering the mining realm, you might wonder whether to adopt a DIY approach or potentially outsource through a hosting contract. Any path taken will boil down to personal preference and resources available. DIY miners may revel in the technical engagement of setting up their rigs, while others could prefer the minimal involvement that comes with leveraging a hosting company’s infrastructure and technical expertise.

Ultimately, investing in cryptocurrency mining hosting contracts presents a thrilling opportunity. Considerations range from financial feasibility and technical specifications to the regulatory framework and market trends. As cryptocurrencies continue to evolve, so too will the dynamics of mining contracts, offering an array of options for innovators and investors alike.

In summary, whether you are drawn towards the allure of Bitcoin mining, enticed by Ethereum’s innovations, or curious about the burgeoning popularity of Dogecoin, the UK’s landscape for mining hosting contracts is ripe for exploration. Arm yourself with knowledge, conduct due diligence, and you may just find a lucrative venture inviting you to participate in a remarkable technological revolution.