How Japan’s Bitcoin Mining Machine Retail Scene Is Shaping the Future of Crypto Mining

In Japan, the metamorphosis of the Bitcoin mining machine retail landscape is captivating and complex, reflecting a broader evolution within the cryptocurrency sphere. With a burgeoning interest in digital currencies like Bitcoin (BTC), Ethereum (ETH), and even Dogecoin (DOG), Japan stands at the forefront of technological advancement and innovation in mining solutions. The nation’s unique regulatory environment, combined with cultural tendencies towards cutting-edge technology, has given rise to a unique ecosystem of businesses that caters to both amateur and professional miners.

Within the mining machine segment, the Japanese market thrives on diversity. Several companies are dedicated to selling the latest models of mining rigs, designed specifically for various currencies. From ASIC miners that are the backbone of Bitcoin mining to FPGA designs for more specialized tasks, retailers in Japan showcase an impressive array of equipment. This diversity is not only a reflection of technological advancement but also of the demand from miners of all skill levels, eager to maximize their hash rates and profitability.

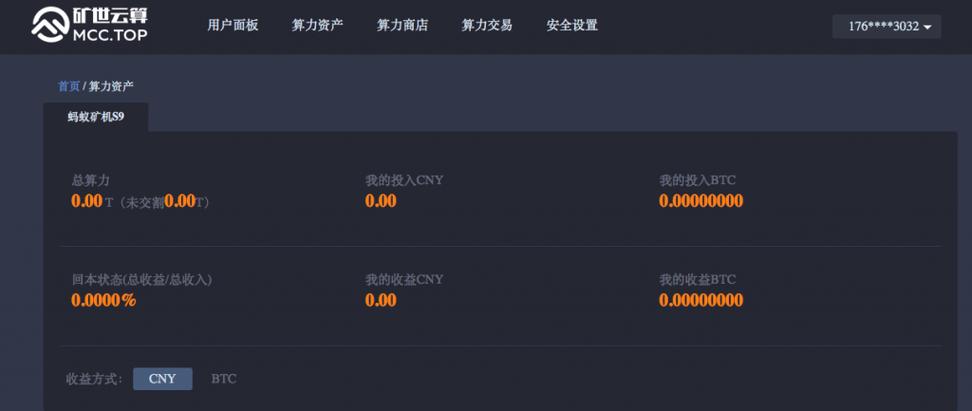

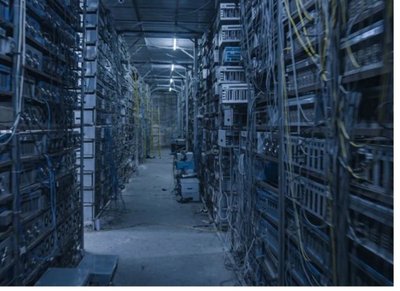

Moreover, the hosting of mining rigs has emerged as a particularly intriguing business model within the Japanese market. A plethora of hosting services offers miners the opportunity to rent space in data centers optimized for mining operations. This is particularly valuable in a country where real estate can be prohibitively expensive. Such facilities are designed with energy efficiency, cooling systems, and high-speed internet to ensure that mining rigs operate at peak performance. The convenience of outsourcing these operational challenges allows miners to focus solely on their strategies for accumulating cryptocurrency.

As the Bitcoin and cryptocurrency landscape continues to evolve, regulation plays a crucial role in shaping the future of mining in Japan. The country is known for its stringent policies regarding taxation, security, and energy consumption. However, this regulatory framework can provide a sense of stability for investors and miners alike, ensuring that they operate within a structured environment. The expectations are that as regulations mature, they will create a level playing field that encourages ethical mining practices and sustainable energy use, integrating seamlessly into global markets.

In addition to regulation, the cultural significance of cryptocurrency in Japan adds an interesting layer. The Japanese populace is generally tech-savvy, and this enthusiasm is reflected in the rapid adoption rates of digital currencies. Retailers, startups, and established corporations are all exploring the realms of blockchain technology and cryptocurrency transactions. This cultural backdrop propels the mining machine retail scene forward, encouraging innovation and exploration in a highly competitive environment.

Additionally, as cryptocurrency becomes integrated into everyday transactions, the demand for mining machines is expected to surge further. This doesn’t just mean higher sales for manufacturers but also signals a critical shift in how cryptocurrencies like Bitcoin, Ethereum, and others are perceived by the public. They are transitioning from speculative assets to viable economic tools, warranting the need for increased mining capabilities to support a growing network of transactions.

The emergence of community-driven initiatives around cryptocurrency in Japan also gives an added dimension to the mining machine retail market. Meetups, workshops, and seminars are increasingly popular, fostering a collaborative spirit among enthusiasts and professionals alike. This community engagement can aid in sharing knowledge on the latest mining technologies, effective strategies, and emerging trends in cryptocurrencies, further pushing the envelope on how mining and retail practices evolve.

Yet, this dynamic scene is not without its hurdles. The volatility of cryptocurrency markets poses challenges, compelling miners to remain agile and informed. Fluctuating prices can directly influence the profitability of mining operations, creating a constant state of uncertainty. Companies dealing in mining machinery must be prepared to adapt quickly, either by refining their offerings or pivoting their business models to remain competitive.

In conclusion, Japan’s Bitcoin mining machine retail landscape is much more than a mere marketplace; it is a reflection of the evolving relationship between technology and society. As the lines between traditional finance and digital currencies blur, the ripple effects can be felt in the bustling streets of Tokyo to the serene landscapes of Hokkaido. With a rich tapestry of regulations, culture, and innovation interwoven, Japan is poised to continue shaping the future of crypto mining—not only within its borders but also on the global stage.