Beginner’s Guide: Finding the Right Mining Hardware for You

Embarking on the journey of cryptocurrency mining can feel like stepping into a vast, electrifying digital frontier, where fortunes are forged from clever code and relentless computation. For beginners, the key to unlocking this potential lies in selecting the right mining hardware—a decision that could define your success in the volatile world of Bitcoin, Ethereum, and beyond. Imagine harnessing the power of specialized machines designed to solve complex puzzles, earning rewards in cryptocurrencies that could change your financial landscape forever. This guide will navigate you through the essentials, blending practical advice with the excitement of innovation, ensuring you’re equipped to make informed choices.

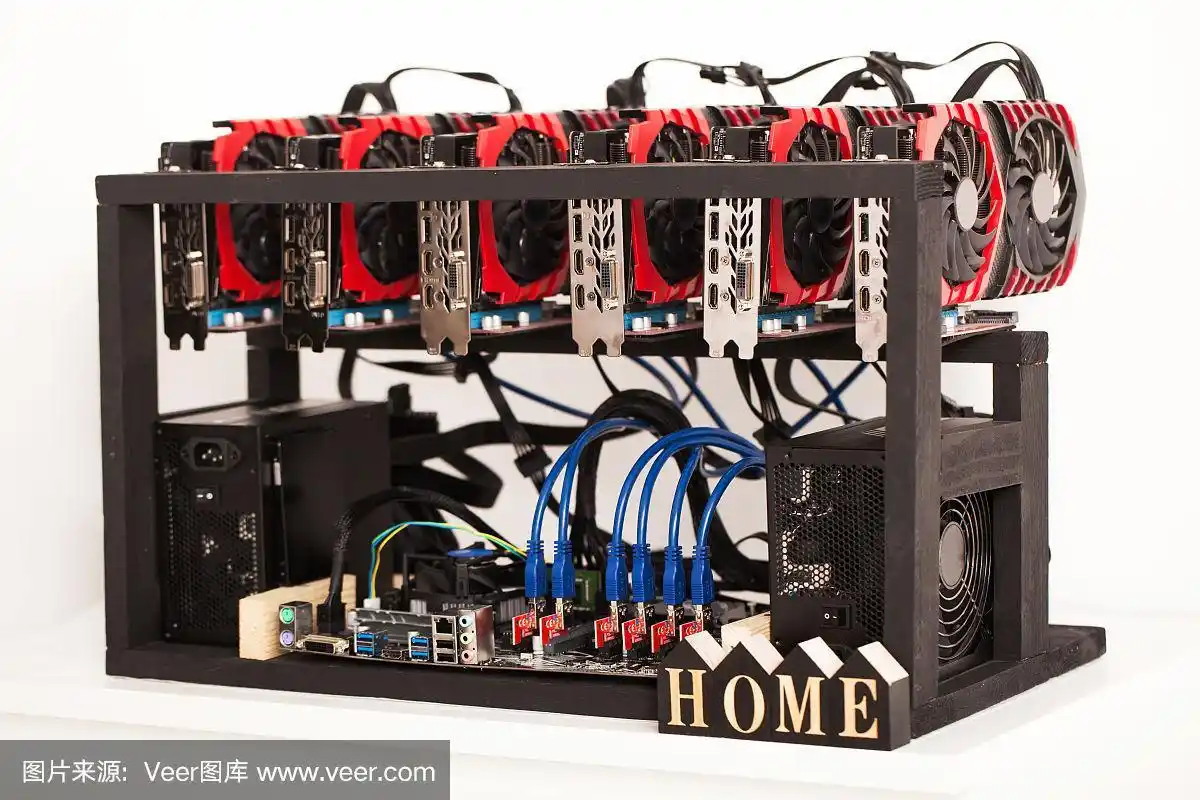

As you dive deeper, it’s crucial to understand the core components of mining hardware. At its heart, mining involves validating transactions on blockchain networks, like those powering BTC (Bitcoin) or ETH (Ethereum). A basic setup might start with a CPU, the brain of your computer, but for serious miners, this quickly evolves into more robust options. GPUs, or graphics processing units, offer a significant leap in efficiency, especially for currencies like Ethereum that favor parallel processing. Then there’s the ASIC miner—Application-Specific Integrated Circuits—tailored exclusively for mining tasks, delivering unparalleled speed and energy efficiency. These devices aren’t just tools; they’re gateways to a community buzzing with innovation and opportunity, where every hash computed brings you closer to your first crypto payout.

Now, let’s talk specifics. If you’re eyeing Bitcoin, known for its robust security and soaring value, you’ll want hardware that can handle its proof-of-work algorithm, SHA-256. ASIC miners dominate here, with models from leading manufacturers turning out hashes at blistering speeds. Picture a sleek, humming machine in your setup, relentlessly working to secure the Bitcoin network while you reap the rewards. In contrast, Dogecoin, with its lighter Scrypt algorithm, might suit a GPU-based rig, making it accessible for newcomers who want to dip their toes without massive investments. This diversity in hardware choices mirrors the unpredictable nature of the crypto market, where one day you’re mining for fun, and the next, you’re optimizing for maximum profitability.

But hardware alone isn’t the full story; consider the ecosystem around it. Mining rigs, those assembled arrays of components including motherboards, power supplies, and multiple GPUs, demand careful planning. For instance, a well-built rig for Ethereum mining could involve several high-end graphics cards, creating a symphony of fans and lights in your space. Yet, not everyone has the room or expertise for at-home setups. That’s where mining farms come into play—vast warehouses filled with optimized hardware, often hosted by companies specializing in this service. By opting for hosted mining, you sidestep the hassles of maintenance and electricity costs, focusing instead on the thrill of watching your investments grow through remote monitoring apps.

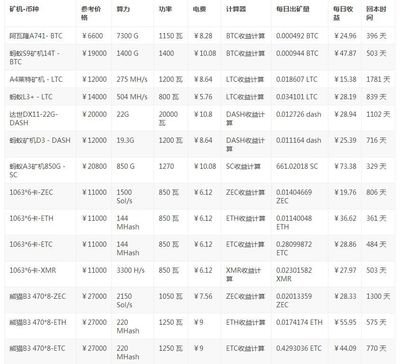

Transitioning to the practicalities, let’s explore how to choose your hardware wisely. Factors like hash rate, energy consumption, and initial cost play pivotal roles. A high hash rate means more guesses per second in the mining lottery, boosting your chances with currencies like BTC or DOG. However, efficiency is king; inefficient miners can drain your wallet faster than they fill it. Diversify your approach by considering hybrid setups: perhaps a dedicated miner for Bitcoin and a rig for Ethereum, allowing you to adapt to market shifts. Remember, the crypto world thrives on burstiness—sudden price surges or network updates—that keep things exhilarating and demand flexible strategies.

Engaging with exchanges is another layer to this adventure. Once you’ve mined your cryptocurrencies, platforms like Binance or Coinbase become your portals to trade, sell, or hold assets. But before that, ensure your hardware integrates seamlessly with mining software, such as CGMiner or EasyMiner, which turn your machines into productive assets. The rhythm of this process—monitoring, adjusting, and optimizing—creates a dynamic narrative, where each day brings new challenges and victories, much like the fluctuating values of ETH or DOG.

In conclusion, finding the right mining hardware is about balancing ambition with practicality, blending the allure of cryptocurrencies with the realities of technology. Whether you’re drawn to the stability of Bitcoin, the community spirit of Dogecoin, or the smart contract capabilities of Ethereum, the path forward involves research, perhaps a visit to a mining farm for hands-on experience, and leveraging services like machine hosting to scale your operations. As you build your setup, embrace the diversity and unpredictability of this field; it’s not just about the hardware, but the stories and successes it helps you create. With the right choices, you’ll be well on your way to thriving in the ever-evolving world of crypto mining.