Cryptocurrency Mining Investment

The world of cryptocurrency mining investment pulsates with the electric hum of innovation and opportunity, drawing in enthusiasts and savvy investors alike. At its core, mining involves the rigorous process of validating transactions on blockchain networks, a task that demands powerful hardware and strategic foresight. For companies specializing in selling and hosting mining machines, this arena represents a golden gateway to profitability. Imagine rows of gleaming machines, whirring away in cooled data centers, churning out digital gold in the form of Bitcoin and other cryptocurrencies. Yet, beyond the surface allure, mining investment weaves a complex tapestry of technological prowess, market volatility, and environmental considerations, making it a thrilling yet unpredictable venture.

Diving deeper, Bitcoin (BTC) stands as the undisputed pioneer of cryptocurrencies, its mining process symbolizing the dawn of a decentralized financial era. Investors flock to BTC mining because of its proven track record and robust network security, which relies on a proof-of-work consensus mechanism. This means that specialized mining rigs, equipped with high-performance GPUs or ASICs, compete to solve intricate mathematical puzzles, thereby securing the network and earning rewards. However, the energy demands are staggering; a single BTC mining operation can consume as much power as a small town. For those venturing into this space, partnering with a hosting service becomes essential. These services provide secure, optimized facilities where your mining machines operate efficiently, handling everything from cooling systems to electricity costs. It’s not just about buying a miner; it’s about investing in a ecosystem that maximizes returns while minimizing risks.

Amidst the giants like BTC, altcoins such as Ethereum (ETH) and Dogecoin (DOG) add layers of diversity to the mining landscape. ETH, with its shift towards proof-of-stake in the Ethereum 2.0 upgrade, challenges traditional mining methods, potentially reducing the need for energy-intensive rigs. Yet, for now, ETH mining still thrives on powerful hardware, offering investors a chance to capitalize on its smart contract capabilities and growing DeFi ecosystem. On the flip side, DOG, born from internet memes, exemplifies the unpredictable nature of crypto markets. Mining DOG can be less resource-heavy, attracting hobbyists with modest setups, but its value swings wildly, turning a simple investment into a rollercoaster ride. This burst of variety ensures that mining isn’t monolithic; it’s a dynamic field where strategies must adapt to the rhythms of different coins.

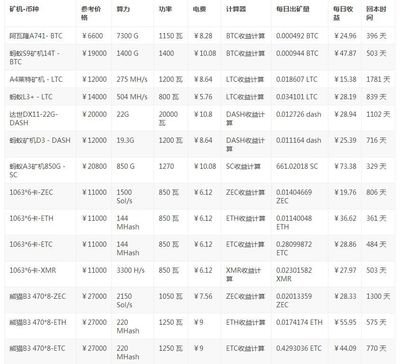

Now, let’s explore the hardware heart of this operation: mining machines and rigs. A typical miner is a compact yet formidable device, packed with processors designed specifically for hashing algorithms. Companies that sell these machines often tailor them for optimal performance on networks like BTC or ETH, ensuring they handle the computational load without overheating. But what about mining rigs? These are the customizable beasts, allowing users to stack multiple miners or GPUs into a single unit for amplified output. The investment here isn’t trivial; it requires weighing costs against potential yields, especially with fluctuating crypto prices. For instance, during a bull market, a well-hosted rig could yield substantial ETH rewards, but in a bear phase, it might barely cover electricity bills. This fluctuation demands a burst of strategic planning, blending technical knowledge with market intuition.

Mining farms emerge as the industrial-scale response to individual efforts, vast warehouses filled with thousands of machines operated by dedicated teams. These farms, often located in regions with cheap electricity like Iceland or China, host operations for investors who prefer not to manage the logistics themselves. By outsourcing to such facilities, you’re not just buying hardware; you’re investing in a managed ecosystem that handles maintenance, security, and even regulatory compliance. Exchanges play a crucial role here too, as they provide the platforms to sell mined cryptocurrencies for fiat or other assets. Picture the scene: fresh-mined BTC flooding into wallets, then swiftly traded on exchanges like Binance or Coinbase, converting digital effort into tangible profit. Yet, this path isn’t without perils—hacks, regulatory crackdowns, and market crashes can upend even the most calculated investments.

In this ever-evolving saga, the allure of cryptocurrency mining investment lies in its potential for high rewards, but it demands a keen eye for detail and a tolerance for uncertainty. From the steady behemoth of BTC to the whimsical surges of DOG, and the innovative strides of ETH, each currency offers unique mining opportunities. Whether you’re setting up a personal miner in your garage or partnering with a professional hosting service for a mining farm, the key is diversification. By spreading investments across machines, rigs, and currencies, you create a portfolio that’s resilient to shocks. As the crypto world marches forward, with advancements like quantum-resistant blockchains on the horizon, mining investment remains a vibrant, rhythmically pulsating field, ripe for those bold enough to dive in.

Ultimately, the future of cryptocurrency mining investment hinges on sustainability and innovation. As global concerns about energy consumption grow, greener alternatives like solar-powered farms or proof-of-stake models could redefine the game. For companies in the business of selling and hosting mining machines, adapting to these shifts will be paramount. Investors must navigate this landscape with a blend of passion and prudence, understanding that while BTC might offer stability, ETH promises evolution, and DOG delivers sheer excitement. In the end, mining isn’t merely about hardware and hashes; it’s a profound investment in the digital economy’s frontier, where every transaction block forged adds another layer to the grand tapestry of modern finance.